Unknown Facts About Feie Calculator

Wiki Article

The Only Guide for Feie Calculator

Table of ContentsExcitement About Feie CalculatorThe Main Principles Of Feie Calculator Excitement About Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.Little Known Facts About Feie Calculator.

He sold his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his spouse to help accomplish the Bona Fide Residency Examination. Neil points out that getting residential or commercial property abroad can be challenging without very first experiencing the location."It's something that individuals need to be truly persistent concerning," he says, and suggests expats to be cautious of common mistakes, such as overstaying in the U.S.

Neil is careful to stress to Stress and anxiety tax united state that "I'm not conducting any performing in Organization. The U.S. is one of the few countries that tax obligations its citizens regardless of where they live, implying that also if an expat has no earnings from United state

tax returnTax obligation "The Foreign Tax obligation Credit history permits people functioning in high-tax countries like the UK to offset their U.S. tax liability by the quantity they've currently paid in tax obligations abroad," says Lewis.

The smart Trick of Feie Calculator That Nobody is Discussing

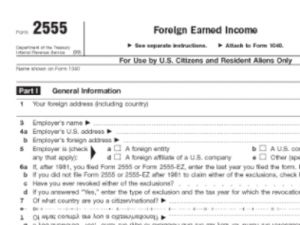

Below are some of one of the most often asked inquiries regarding the FEIE and other exclusions The International Earned Income Exclusion (FEIE) enables united state taxpayers to leave out as much as $130,000 of foreign-earned income from government income tax, reducing their U.S. tax liability. To get FEIE, you should meet either the Physical Existence Test (330 days abroad) or the Authentic Residence Test (verify your key house in a foreign nation for an entire tax year).

The Physical Existence Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Existence Examination likewise needs united state taxpayers to have both an international earnings and an international tax home. A tax home is specified as your prime location for business or work, regardless of your household's home.

Rumored Buzz on Feie Calculator

An earnings tax obligation treaty in between the united state and another nation can assist prevent dual taxation. While the Foreign Earned Earnings Exclusion minimizes taxable income, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed filing for united state citizens with over $10,000 in foreign economic accounts.Qualification for FEIE depends on meeting details residency or physical visibility examinations. He has over thirty years of experience and currently specializes in CFO services, equity payment, copyright taxation, marijuana taxation and separation relevant tax/financial planning issues. He is an expat based in Mexico.

The foreign earned earnings exclusions, occasionally described as the Sec. 911 exemptions, leave out tax on incomes earned from working abroad. The exemptions comprise 2 components - a revenue exclusion and a real estate exemption. The following FAQs talk about the advantage of the exclusions including when both partners are deportees in a basic manner.

4 Simple Techniques For Feie Calculator

The tax advantage excludes the income from tax obligation at bottom tax obligation rates. Previously, the exemptions "came off the top" decreasing revenue topic to tax obligation at the leading tax rates.These exemptions do not excuse the salaries from United States taxation yet just supply a tax obligation decrease. Keep in mind that a bachelor functioning abroad for every one of 2025 that gained about $145,000 without any various other revenue will have gross income decreased to absolutely no - successfully the same response as being "free of tax." The exemptions are calculated every day.

Report this wiki page